Many Middle-Income Seniors Will Not Be Able to Pay for Long-Term Care and Housing in 10 Years

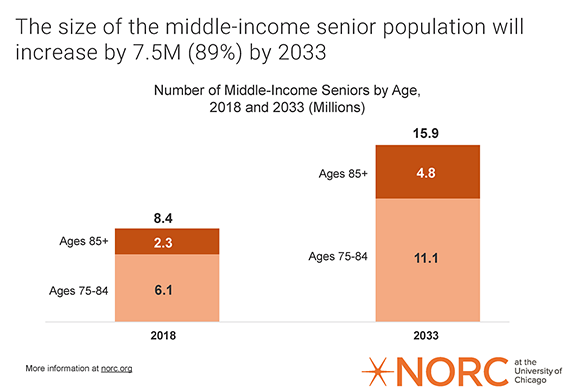

Total Number of Middle-Income Seniors Expected to Grow by 89 Percent by 2033.

CHICAGO, August 31, 2022 – By 2033, more than 11 million middle-income seniors aged 75 and older may not be able to pay for assisted living and are also unlikely to qualify for Medicaid to pay for their long-term care needs. In an update of their groundbreaking “Forgotten Middle” study, researchers from NORC at the University of Chicago find that the middle-income cohort of seniors will grow by 7.5 million (89 percent) from 2018 to 2033. The study also found that seniors are becoming more racially and ethnically diverse, with people of color making up 22 percent of this middle-income population in 2033.

Funded by The SCAN Foundation, this new analysis examines the size, demographics, health needs, and financial resources of middle-income seniors aged 75 and older in 2033. As people age, they may experience increasing health needs, deteriorating mobility, and cognitive impairment. These conditions can make it challenging for seniors to live independently in their homes without additional caregiving support. While many people rely on unpaid caregiving from family and friends, others will require paid support. For those who need or want it, assisted living is an important housing and care alternative.

“Without a comprehensive long-term care system in this country, for all but the lowest-income individuals, the costs of senior housing and caregiving support falls to seniors and their families,” said Caroline Pearson, senior vice president at NORC and the lead author. “Sadly, most middle-income seniors may not have the financial resources to pay for the care they want and need.”

Key findings from the study illustrate the likely need many seniors will experience regarding long-term care and housing, including:

- Future seniors are less likely to be married, and many do not have children living nearby.

- Among middle-income seniors, more than half will have three or more chronic conditions, and 56 percent will have mobility limitations.

- One in three seniors will face cognitive impairments, with that percentage growing to 40 percent for those 85 and older.

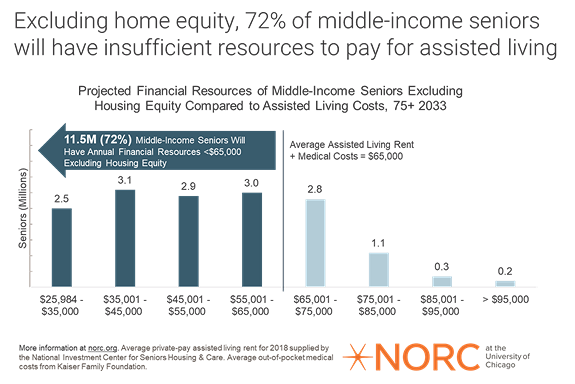

In 2033, 72 percent of middle-income seniors (11.5 million) will have less than $65,000 in income and annuitized assets—the average amount needed to pay for private assisted living and medical care. Even if these seniors sold their homes, 6.1 million (39 percent) would still have insufficient resources to pay those annual costs.

“Eleven-and-a-half million older adults won’t qualify for public assistance and will most likely be unable to pay for their long-term care and assisted living,” said Dr. Sarita A. Mohanty, president and CEO of The SCAN Foundation. “Homeowners may be forced to sell their homes and even then, many will not be able to afford their needs.”

“In addition to the urgent problem elucidated by these new findings, NORC’s work also shows us that the middle-income, older adult population is becoming more racially and ethnically diverse. We need a long-term care system and one that is responsive to the cultural needs and preferences of a more diverse set of older adults and families,” added Mohanty.

Methodology

This analysis relies on the Health and Retirement Study (HRS), using 2018 as a base year. Researchers at NORC examined individuals who were aged 60 and older in 2018 since they will be aged 75 or older in 2033. For each of these individuals in the sample, the researchers modeled the probability of living to 2033 for inclusion in the future seniors cohort.

The researchers then examined the time-invariate demographic attributes of this group, such as gender, race, and education. They estimated people’s health, cognitive function, and mobility status assuming the same rates of these conditions that exist in the 2018 population, for each demographic subgroup.

The researchers also modeled these individuals’ future financial resources, starting from their actual income and assets in 2018. They grew these assets based on the historical rate of change for each type of financial resource and annuitized assets across individual’s life expectancy.

The researchers analyzed financial resources at an individual level instead of a household basis, as is common. By characterizing resources at an individual level, the research is better able to account for differences in life expectancy and health needs of spouses. This also enables us to compare resources against annual housing and care costs.

The analysis’ measure of financial resources includes income streams (i.e., Social Security) and annuitized assets (i.e., retirement savings or mutual funds). For some seniors, adult children may make financial contributions to support their senior housing and care, though this analysis does not assume any financial support from adult children. The researchers include information about housing equity but hold this separately, as some individuals may be reluctant to sell their home or may have a spouse who continues to live in the home. Additionally, some seniors may want to retain their home as a “nest egg” to protect against outliving their assets or having a catastrophic health event.

About NORC at the University of Chicago

NORC at the University of Chicago conducts research and analysis that decision-makers trust. As a nonpartisan research organization and a pioneer in measuring and understanding the world, we have studied almost every aspect of the human experience and every major news event for more than eight decades. Today, we partner with government, corporate, and nonprofit clients around the world to provide the objectivity and expertise necessary to inform the critical decisions facing society.

Contact: For more information, please contact Anna-Leigh Ong at NORC at ong-anna-leigh@norc.org or (917) 242-2172 (cell).

About The SCAN Foundation

The SCAN Foundation is an independent public charity devoted to transforming care for older adults in ways that preserve dignity and encourage independence. Our mission is to advance a coordinated and easily navigated system of high-quality services for older adults so they can access health and supportive services of their choosing to meet their needs. Across all the work we fund, we value projects that are bold, catalytic, and impact-oriented.