On Shaky Ground: Many Americans Over 50 Have Little Faith in Government and Financial Institutions

Foresight 50+

Foresight 50+ by AARP and NORC offers deep insight into the views and behaviors of Americans 50 and older.

For inquiries, contact Martha Crowley:

July 2023

Trust in institutions is essential to functioning societies. That’s why it’s important to routinely take the pulse of the nation, especially of the country’s fastest-growing age group, people 50 and older.

To gauge whether people ages 50+ trust government and financial institutions, we surveyed them using our monthly Foresight 50+ Omnibus survey, a probability-based panel developed by NORC at the University of Chicago and AARP. The nation’s largest and most representative panel of Americans 50 and older, Foresight 50+ is best equipped to poll this group because it combines AARP’s consumer expertise with NORC’s scientific rigor.

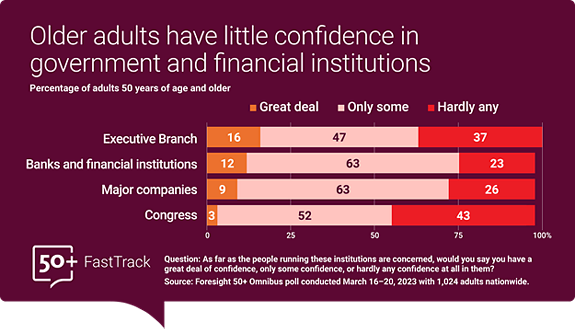

We found only 12 percent of the poll’s 1,024 respondents report a great deal of confidence in banks and financial institutions, while 63 percent are only somewhat confident in them. About a quarter of older adults have hardly any confidence in financial institutions. People from lower-income households are more skeptical of the financial sector—and major companies—than their higher-income counterparts. Specifically, 29 percent of lower-income households have hardly any confidence in the bank and financial sector compared to 18 percent of higher-income households.

Poll respondents trust the Executive Branch and Congress even less. See the following graphic for a breakdown.

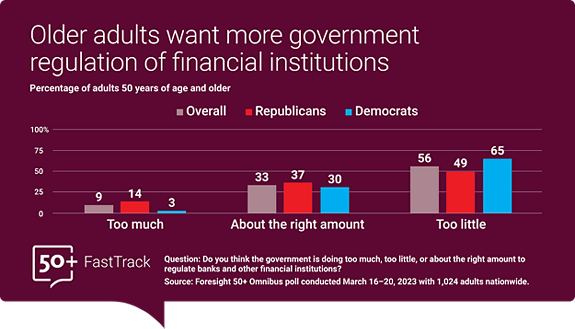

Half of those we spoke with also believe the government is doing too little to regulate financial institutions. When broken down along party lines, a majority of Democrats (65 percent) want more government regulation of the financial sector while slightly less than half of Republicans (49 percent) do.

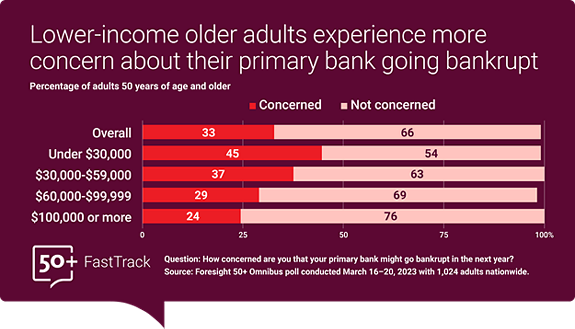

Interestingly, despite an expressed lack of faith in financial institutions, few respondents say that they worry about their own bank going bankrupt. Again, people from lower-income households are more concerned than those from higher-income ones. But, regardless of income, the majority of older adults (66 percent) are not worried about their primary bank closing its doors.

These findings come from online and telephone (landline and mobile) interviews with 1,024 U.S. adults on the Foresight 50+ Omnibus Survey, March 16–20, 2023. The margin of sampling error was +/- 4.0 percentage points. The survey was conducted shortly after Silicon Valley Bank (Santa Clara, CA) and Signature Bank (New York, NY) became two of the largest bank failures in U.S. history. A third large bank, First Republic, failed in May 2023.

This poll is the first in a new series of Foresight 50+ Omnibus panel surveys focused on amplifying the voices of people 50 and over. Now more than ever, policymakers and others need this type of scientifically rigorous and readily available data in real time to help them improve policies and programs for an aging population. The Foresight 50+ FastTrack series—a set of periodic insights using the panel—will meet this need by regularly providing key findings and insights, on an array of topics, that might otherwise be unavailable to the public. The series will also showcase ways in which organizations can use the panel to answer their own questions about the highly influential 50+ demographic.

The large Foresight 50+ panel can oversample a variety of target groups, such as Medicare beneficiaries, grandparents, frequent travelers, and others. Combined with our affordable TrueNorth methodology, Foresight 50+ can incorporate data from lower-quality sample sources to gain insight into even smaller subpopulations, such as people with food allergies, veterans, and those with various health conditions.