Many Middle-Income Seniors Won’t Be Able to Pay for Housing in 10 Years

This article is from our NORC Now newsletter. Subscribe today.

September 2022

As Americans age and their caregiving needs increase due to health, mobility, and cognition declines, their options for housing and health care depend on their personal financial resources. Very low-income individuals may qualify for long-term care services from Medicaid, and high-income individuals can often afford a wide range of housing and health care options. But middle-income older adults, who face a lack of affordable assisted living options, have traditionally relied on unpaid caregiving from family and friends to help them live independently. That model will soon become untenable.

Among middle-income seniors, more than half will have three or more chronic conditions, and 56 percent will have mobility limitations.

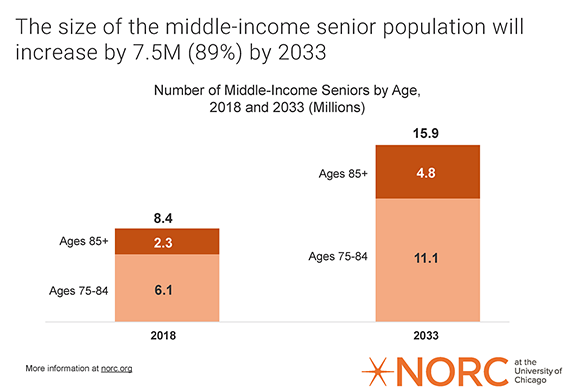

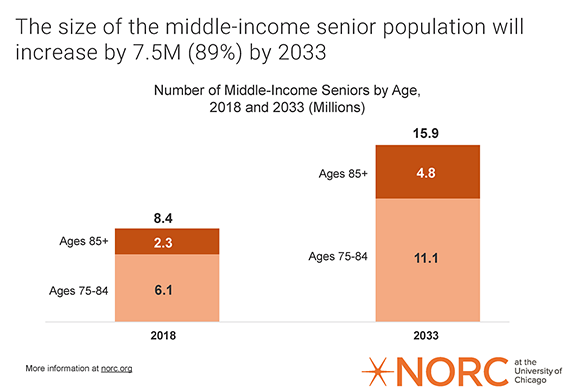

NORC researchers, with funding from The SCAN Foundation, updated their original “Forgotten Middle” study published in 2019 and found that from 2018 to 2033 the number of middle-income adults 75 and older will increase by 7.5 million (89 percent). In 2033, 72 percent of those adults (11.5 million) will have less than $65,000 in income and annuitized assets, the average amount needed for private assisted living and medical care. Adding to that financial crisis is an ongoing change in the American family structure: fewer seniors will be married and fewer will have children or live near their children.

This article is from our flagship newsletter, NORC Now. NORC Now keeps you informed of the full breadth of NORC’s work, the questions we help our clients answer, and the issues we help them address.