New National Survey Finds Almost 40 Percent of Americans Are Experiencing Decreases in Income, Young Adults and Hispanic Families Especially Hard Hit

More than a quarter of U.S. families with decreases in income are taking on debt to weather the financial storm.

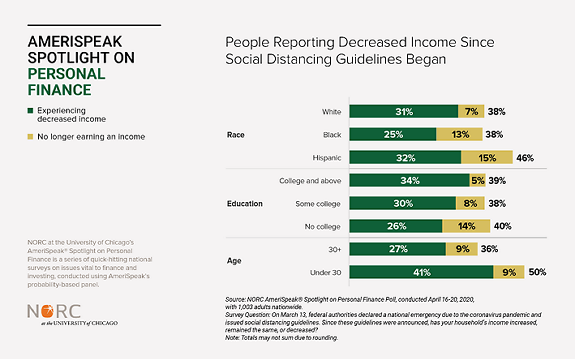

CHICAGO, April 28, 2020 – As the United States enters another month with much of the country under stay-at-home orders, families around the country are experiencing substantial decreases in income. According to a new AmeriSpeak® Spotlight on Personal Finance from NORC at the University of Chicago, thirty percent of households report some decrease in income, and an additional 9 percent report no longer earning an income at all.

Some groups have been hit harder than others—half (50 percent) of those under age 30 and 47 percent of Hispanic households reported some kind of lost income. While some families are experiencing a decrease in income, others report they are no longer earning an income at all; twice as many black and Hispanic Americans report they are no longer earning any income, when compared to white Americans. Those with no college education report they are no longer earning an income at almost three times the rate of college graduates.

When asked how long they think it will be until their income returns to pre-COVID-19 levels, most people indicated between one and five months. However, 16 percent of all respondents indicated they do not believe their income willever return to pre-COVID-19 levels. For those with no college education, 1 in 5 (21 percent) indicated they did not believe their income would ever return to pre-COVID-19 levels.

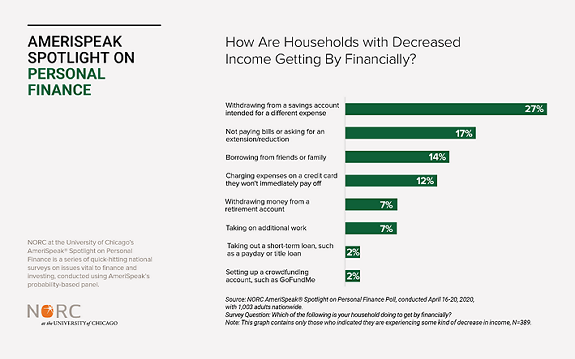

In light of decreasing income, households are using a variety of strategies to get by financially. More than a quarter of households experiencing decreased income reported using existing savings, and 17 percent indicated they are behind in bills or asking for extensions or reductions. Of concern, 28 percent reported taking on debt (by either using credit cards, borrowing from friends or family, or taking a short-term loan) to get by.

Federal stimulus payments will primarily be used to pay regular expenses.

Federal stimulus payments may provide some relief to struggling households. Among households with lost income, many households (45 percent) will spend stimulus funds to pay regular expenses, indicating funds may be providing much-needed economic support. Conversely, among households that have not lost income, more intend to save the funds—44 percent said they would save the money in either a transaction account, or as part of their retirement savings.

“For the most part, it appears the CARES Act stimulus funds are being used for their intended purpose,” said Mark Lush, manager in the BEAD team at NORC. “People are either using the money to cover their costs now or putting the money in short-term savings for potential future needs.”

Methodology

The self-funded poll was conducted between April 16 and April 20, 2020, during a monthly Omnibus. It included 1,003 interviews with a nationally representative sample (margin of error +/- 4.33 percentage points) of adult Americans age 18+ using the AmeriSpeak Panel. AmeriSpeak® is NORC’s probability-based panel designed to be representative of the U.S. household population. A comprehensive listing of all study questions, tabulations of top-level results for each question.

About the AmeriSpeak Spotlight on Personal Finance

NORC at the University of Chicago’s AmeriSpeak® Spotlight on Personal Finance is a series of quick-hitting national surveys on issues vital to finance and investing, conducted using AmeriSpeak’s probability-based panel.

About NORC at the University of Chicago

NORC at the University of Chicago conducts research and analysis that decision-makers trust. As a nonpartisan research organization and a pioneer in measuring and understanding the world, we have studied almost every aspect of the human experience and every major news event for more than eight decades. Today, we partner with government, corporate, and nonprofit clients around the world to provide the objectivity and expertise necessary to inform the critical decisions facing society.

Contact: For more information, please contact Anna-Leigh Ong at NORC at ong-anna-leigh@norc.org or (917) 242-2172 (cell).