As COVID-19 Continues, 40 Percent of Laid-off Workers Are Turning to Debt to Get By

Americans adjust expectations for financial recovery and return to work downwards.

CHICAGO, June 11, 2020 – Two months after widespread COVID-related shutdowns began, 11 percent of Americans have been temporarily or permanently laid off as a result of the COVID-19 pandemic, according to a new AmeriSpeak® Spotlight on Personal Finance from NORC at the University of Chicago. Even among those still working, many Americans are experiencing decreases in income—26 percent of workers report some decrease of income, and 6 percent report they are no longer earning any income at all.

Layoffs have hit some groups harder than others. In particular, Hispanic workers reported layoffs at 1.5 times the rate of white workers, those without a college degree report layoffs at twice the rate of those with a college degree, and workers under 30 report layoffs at a rate greater than double that of older workers.

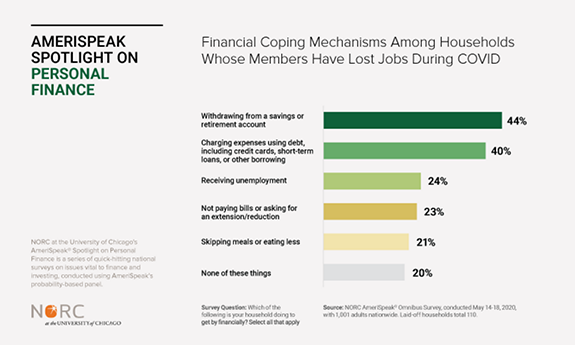

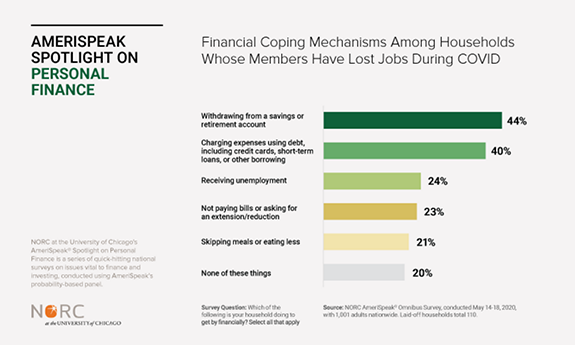

These laid-off workers are using a variety of coping strategies to get by financially, some with long-term effects on financial well-being. While many are tapping into savings or postponing bills, 40 percent of laid-off workers are using debt (credit cards, short-term loans, or borrowing from friends or family) to get by financially. Shockingly, 21 percent report skipping meals or eating less.

“Despite relief efforts by the federal government, workers who have lost their jobs as a result of the COVID-19 pandemic are really struggling, and resorting to coping mechanisms that are likely to have long-lasting impacts,” said Angela Fontes, director of the Behavioral and Economic Analysis and Decision-Making (BEAD) team at NORC. “While jobs may come back as the economy opens up, the debt that families are incurring may take years to pay off.”

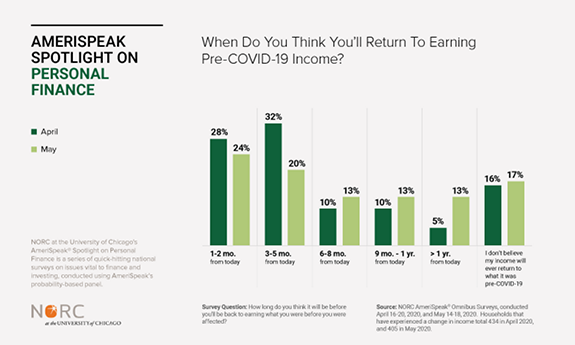

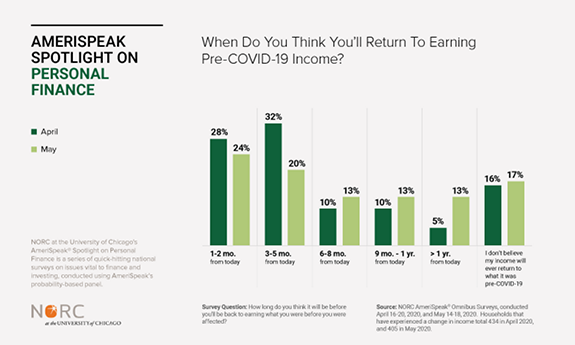

As the pandemic continues to impact the incomes of many American households, people are adjusting their estimates of when they believe work will return to pre-COVID-19 levels. The percentage of impacted workers who anticipated a return to normal in less than six months decreased from 60 percent in April to 44 percent in May, and the percentage of workers expecting “at least a year” to get to recovery increased from 5 percent to 13 percent.

“We’re seeing laid-off workers update their expectations in real-time, with households pushing out their timeframes for recovery,” said Mark Lush, manager and behavioral scientist of the BEAD team at NORC. “The expectation seems to be that the longer the downturn lasts, the longer it will be before workers are back to earning their pre-COVID income.”

Methodology

The self-funded poll was conducted between May 14 and May 18, 2020, during a monthly Omnibus. It included 1,001 interviews with a nationally representative sample (margin of error +/- 4.37 percentage points) of adult Americans age 18+ using the AmeriSpeak Panel. AmeriSpeak® is NORC’s probability-based panel designed to be representative of the U.S. household population. A comprehensive listing of all study questions, tabulations of top-level results for each question, , and detailed methodology is available below.

About the AmeriSpeak Spotlight on Personal Finance

NORC at the University of Chicago’s AmeriSpeak® Spotlight on Personal Finance is a series of quick-hitting national surveys on issues vital to finance and investing, conducted using AmeriSpeak’s probability-based panel.

About NORC at the University of Chicago

NORC at the University of Chicago conducts research and analysis that decision-makers trust. As a nonpartisan research organization and a pioneer in measuring and understanding the world, we have studied almost every aspect of the human experience and every major news event for more than eight decades. Today, we partner with government, corporate, and nonprofit clients around the world to provide the objectivity and expertise necessary to inform the critical decisions facing society.

Contact: For more information, please contact Eric Young at NORC at young-eric@norc.org or (703) 217-6814 (cell).