Most Working Americans Would Face Economic Hardship If They Missed More than One Paycheck

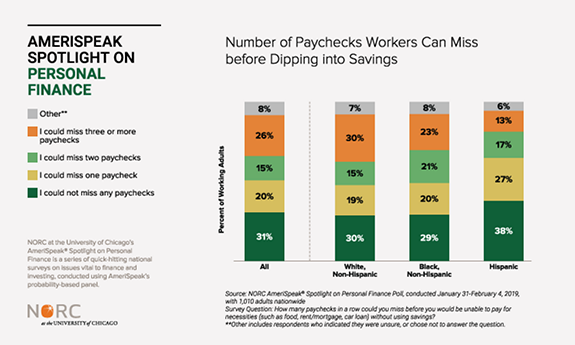

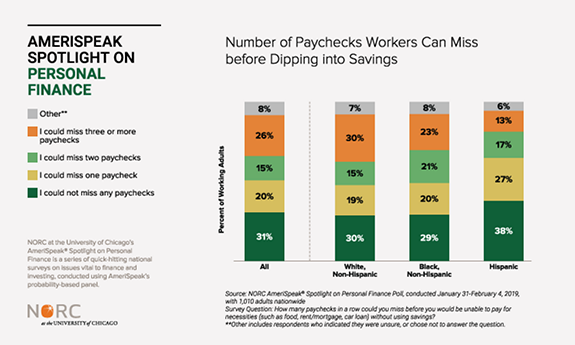

CHICAGO, May 16, 2019 — Fifty-one percent of working adults indicated that missing more than one paycheck would mean that they could not cover necessities without accessing savings, according to a new AmeriSpeak® Spotlight on Personal Finance survey from NORC at the University of Chicago. An additional 15 percent would experience hardship after missing two paychecks.

Low-income and Hispanic households report particular hardship due to missed paychecks—65 percent of Hispanic households and 67 percent of households earning less than $30,000 annually would be unable to pay for necessities if they missed more than one paycheck.

“Even short disruptions in pay can cause significant hardship, as most Americans appear to be living paycheck-to-paycheck,” said Angela Fontes, director of the Behavioral and Economic Analysis and Decision-making (BEAD) program at NORC at the University of Chicago. “The issue is particularly salient for Hispanic and for low-income households, where the vast majority of these households would need to begin depleting savings, if they have any, sooner.”

Households use a variety of strategies to manage income disruptions such as missing two consecutive paychecks. The most frequently reported management strategy is decreasing spending on optional expenses (73 percent). Other frequently cited strategies include termination of regular savings (43 percent) or retirement contributions (28 percent), and withdrawal of funds from regular savings (40 percent). One-third (31 percent) of households report that they would need to skip the purchase of essentials if they missed two paychecks, with 46 percent of low-income families skipping essentials.

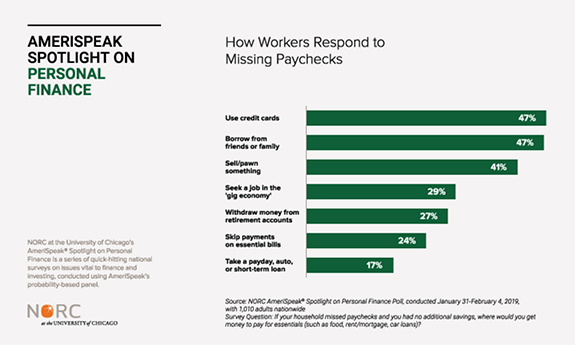

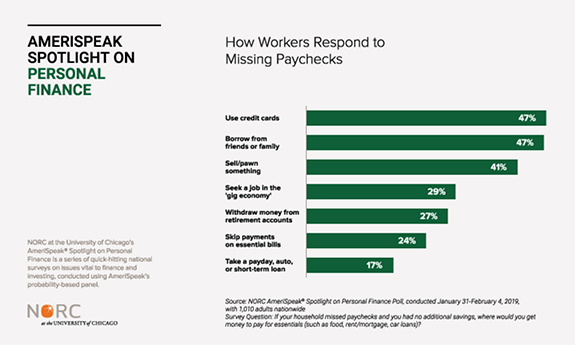

When asked how they would get money for essentials if they did not have additional savings, almost half (47 percent) of households indicated they would turn to credit cards. More alarming is that 17 percent would take a paycheck, auto, or other type of short-term loan. With interest rates in the 400-800 percent range, turning to these short-term loans as a substitute for regular income can be a costly alternative.

“Research shows that high interest rates on credit cards and short-term loans can be particularly dangerous fallback options that may increase debt and financial challenges over time. While the funds made available through a short-term loan may address an immediate financial need, these quick-fix solutions frequently come with long-term consequences,” said Fontes.

Methodology

The self-funded poll was conducted between January 31 and February 4, 2019, during a monthly omnibus. It included 1,010 interviews with a nationally representative sample (margin of error +/- 4.29 percentage points) of adult Americans age 18+ using the AmeriSpeak® Panel. AmeriSpeak® is NORC’s probability-based panel designed to be representative of the U.S. household population. A comprehensive listing of all study questions, tabulations of top-level results for each question.

About the AmeriSpeak Spotlight on Personal Finance

NORC at the University of Chicago’s AmeriSpeak® Spotlight on Personal Finance is a series of quick-hitting national surveys on issues vital to finance and investing, conducted using AmeriSpeak’s probability-based panel.

About NORC at the University of Chicago

NORC at the University of Chicago conducts research and analysis that decision-makers trust. As a nonpartisan research organization and a pioneer in measuring and understanding the world, we have studied almost every aspect of the human experience and every major news event for more than eight decades. Today, we partner with government, corporate, and nonprofit clients around the world to provide the objectivity and expertise necessary to inform the critical decisions facing society.

Contact: For more information, please contact Anna-Leigh Ong at NORC at ong-anna-leigh@norc.org or (917) 242-2172 (cell).