Most U.S. Taxpayers Don’t Know How Effects Of Pandemic Will Impact Their Taxes: Five Tax Myths Debunked

CHICAGO, April 5, 2021 – While the recently passed stimulus bill may provide much-needed financial relief for many families, it additionally complicates an already complex tax season. When asked five true or false questions about tax myths—like whether or not people have to pay taxes on unemployment insurance payments or if they can claim home offices as a deduction—just 1 in 20 U.S. taxpayers (5 percent) answered all five questions correctly. On average, respondents answered fewer than three questions correctly (2.89 out of 5) and respondents with lower incomes less frequently answered questions correctly.

MYTH #1: People don’t have to pay taxes if they didn’t earn any income.

FALSE. Many non-earned income sources are taxable, including alimony, stock options or dividends, or royalties.

MYTH #2: If someone worked from home instead of their usual place of employment last year, they can claim their home office as a deduction on their taxes.

FALSE. To be claimed, your home office must be your principle place of business, and the space used exclusively for conducting business. If you are employed by a company or organization (rather than yourself) you cannot claim this deduction.

MYTH #3: People don’t have to pay taxes on what they received in their stimulus checks.

TRUE. Stimulus payments are not taxed.

MYTH #4: People don’t have to pay taxes on unemployment payments.

FALSE. While the recent stimulus bill makes some unemployment payments received in 2020 tax-free for some people, unemployment payments are taxable income.

MYTH #5: Income from a “side hustle” job is not subject to income taxes.

FALSE. Income earned from gig economy jobs is still taxed.

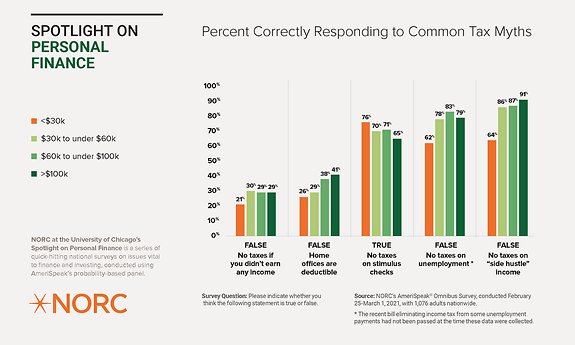

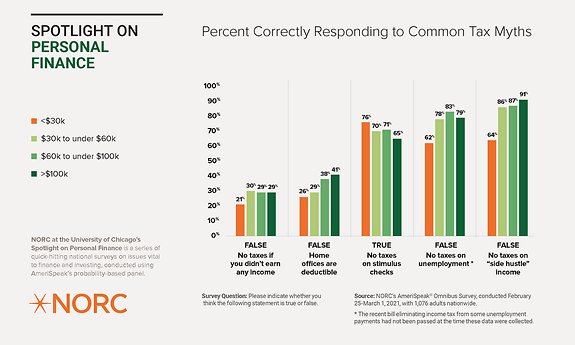

The following figure shows the percentage of respondents by income level who answered each question correctly.

Spotlight on Personal Finance:

Percent Correctly Responding to Common Tax Myths

“Taxes are complicated in normal times. Throw unemployment, stimulus checks, and working from home in the mix, and families may have a hard time with accurate tax filings this year. Our results suggest lower income households, who may be most reliant upon a refund and have less access to tax advice, may be the least prepared to file this year,” says Angela Fontes, vice president of the Economics, Justice, and Society department at NORC at the University of Chicago. “These families may see reduced or delayed refunds as a result, potentially causing bills to be late, or interest on debt to accumulate.”

The findings come from a survey of U.S. adults conducted by NORC at the University of Chicago.

Methodology

The self-funded poll was conducted between February 25 and March 1, 2021, during a monthly Omnibus survey. It included 1,076 interviews with a nationally representative sample (margin of error +/- 4.09 percent) of adult Americans age 18+ using the AmeriSpeak Panel. AmeriSpeak® is NORC’s probability-based panel designed to be representative of the U.S. household population. A comprehensive listing of all study questions, tabulations of top-level results for each question.

About the AmeriSpeak Spotlight on Personal Finance

NORC at the University of Chicago’s AmeriSpeak® Spotlight on Personal Finance is a series of quick-hitting national surveys on issues vital to finance and investing, conducted using AmeriSpeak’s probability-based panel.

About NORC at the University of Chicago

NORC at the University of Chicago conducts research and analysis that decision-makers trust. As a nonpartisan research organization and a pioneer in measuring and understanding the world, we have studied almost every aspect of the human experience and every major news event for more than eight decades. Today, we partner with government, corporate, and nonprofit clients around the world to provide the objectivity and expertise necessary to inform the critical decisions facing society.

Contact: For more information, please contact Eric Young at NORC at young-eric@norc.org or (703) 217-6814 (cell).